Electricity Market Complex Adaptive System (EMCAS)

Background: While planning and operation of traditional electric utility systems used to be strongly driven by least-cost and reliability concerns, recent trends toward restructuring and unbundling are creating opportunities for new participants with new business models to enter the markets and are creating diverse and dynamic markets. Centralized, monopolistic decision-making organizations are giving way to heterogeneous, decentralized decision structures. The “single” decision-maker is replaced by a host of decision entities each with their own, unique business strategies, risk preferences, and decision models.

The implicit assumption of a centralized decision-making process built into many of the global optimization and equilibrium-based power systems analysis tools developed over the last two decades limits their ability to adequately analyze the forces prevalent in today’s emerging markets. This is amplified by recent experiences that have shown the difficulties of understanding the operation of these markets.

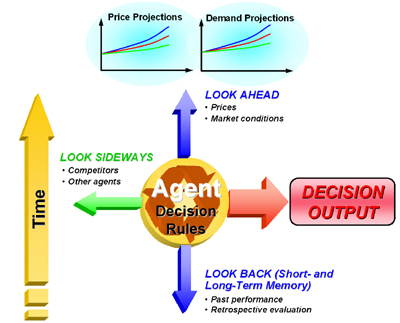

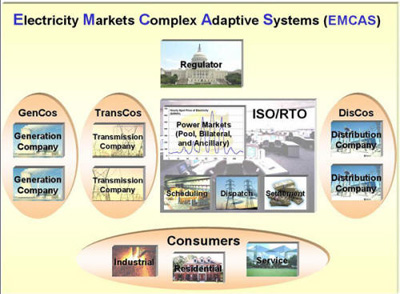

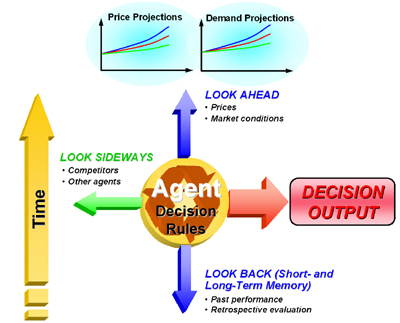

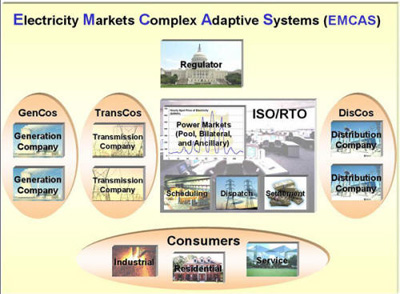

Argonne Approach: The Center for Energy, Environmental, and Economic Systems Analysis (CEEESA) has been developing EMCAS, the Electricity Market Complex Adaptive System model, in which the diverse participants in the electricity market are represented as “agents.” All agents have their own set of objectives, decision-making rules, and behavioral patterns. Further, agents can draw on an array of historical information (e.g., past power prices) and projected data (e.g., next-day load) to support their unique decision process.

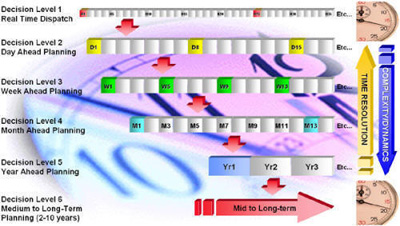

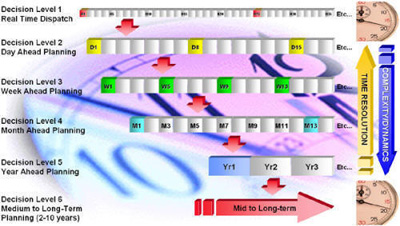

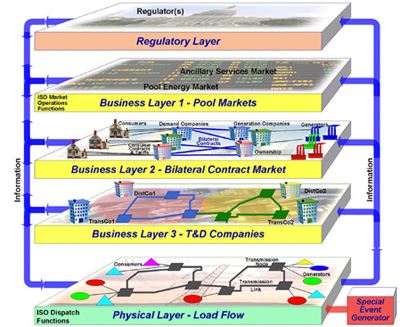

EMCAS Design: An EMCAS simulation runs over six decision levels, ranging from hourly dispatching to long-term planning (see figure above). At each decision level, agents make certain decisions, including determining electricity consumption (customer agents), unit commitment (generation companies), bilateral contracting (generation and demand companies), and unit dispatch (ISO/RTO agent). Agents then apply their own decision rules and evaluate how well these rules meet their objectives.

Rules that fail to meet objectives can be modified in subsequent time steps. In this manner, agents may “learn” from past efforts and gravitate to strategies that improve their respective positions. Agents go through a look-back-look-ahead process (see figure above). This approach allows for exploration of a wide range of behaviors that cannot be captured by conventional optimization or equilibrium methodologies.

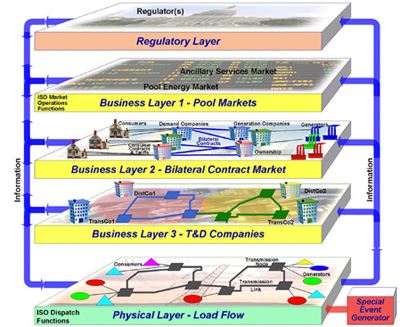

An EMCAS simulation includes both the customers who represent the end users of electricity and the demand companies from whom they purchase electricity. The latter can be conventional distribution companies or brokers. EMCAS also includes the physical generators and the generation companies that own them and the transmission lines and busses and the transmission companies that own them. An independent system operator (ISO) or regional transmission operator (RTO) can be included when one exists. The agents interact on several layers, including a physical layer, several business layers, and a regulatory layer (see below).

|

|

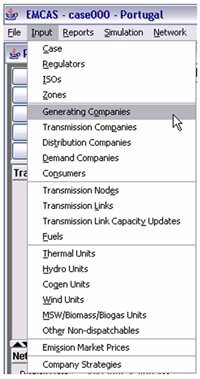

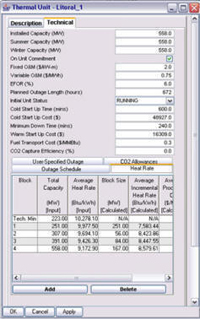

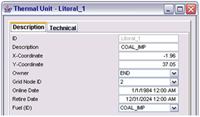

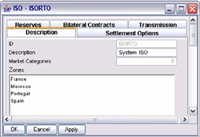

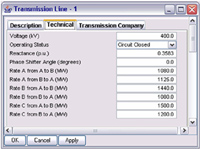

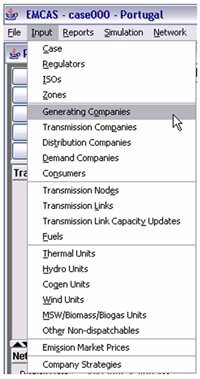

EMCAS Input Screens

|

|

EMCAS can simulate various market operating rules established by a regulator agent. The rules can range from a conventional vertically integrated utility operating under rules established by a local public utility commission to a fully deregulated market operating under forward bidding procedures, such as some that are already in place. A market information system provides data used by all participants. A random event generator allows for simulation of unexpected incidents, such as generator or transmission line outages.

What Makes EMCAS Unique? What sets the EMCAS design apart from most other models is the unique combination of methodologies and modeling approaches. EMCAS combines agent-based modeling and simulation with the following modeling techniques:

- Complex-adaptive systems approach to represent agent learning and adaptation

- Utility function characterization of agent objectives

- Heuristic optimization for unit commitment

- Demand response functions to reflect consumer reaction

- Transmission load flow analysis.

What Can EMCAS Do for You? The unique combination of approaches makes EMCAS a very powerful market analysis tool. Here are some of the strengths of EMCAS:

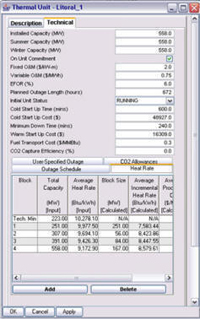

- Combines Engineering Techniques with Quantitative Market Analysis: DC load flow models allow you to simulate the actual operation of the physical system configuration. Generators and transmission nodes are represented at the individual bus-level; transmission lines are represented as individual branches.

- Decentralized Decision Making: EMCAS allows you to represent multiple market participants and agents with decentralized, individual company-level decision-making capabilities. Each agent seeks to maximize its own utility that is derived from a “corporate utility function” that can combine multiple objectives. Each company agent has a set of corporate objectives, such as profit, risk exposure, market share, etc.

- Alternative Company Strategies and Risk Profiles: EMCAS allows you to simulate a number of alternative company strategies as it provides the agents with access to a wide range of market strategies to fit their different risk preferences (from risk-averse to risk-prone).

- Learning and Adaptation: EMCAS allows you to incorporate agent learning and adaptation based on past performance and changing conditions.

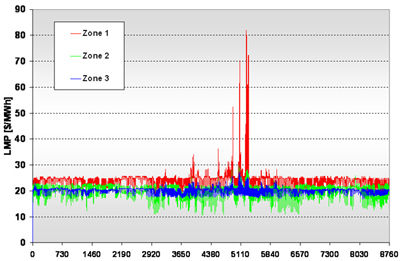

- Different Markets with Different Rules: EMCAS explicitly models energy spot markets, bilateral contract markets, and ancillary services markets. EMCAS allows you to change market rules to test market operation and analyze the behavior of both individual agents and the system under different market configurations.

- Transient Market Conditions and Emerging Behavior: As most energy markets are rarely in equilibrium, EMCAS allows you to study transient market conditions that receive increasing attention. The overall market behavior emerges from agent interactions. EMCAS allows you to identify contributors to system problems.

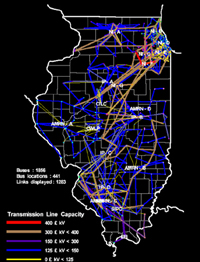

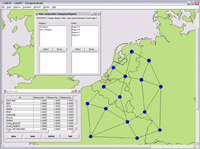

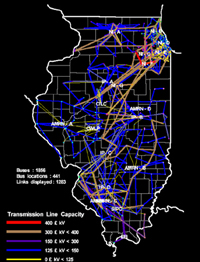

EMCAS Applications: EMCAS is increasingly used to study restructuring issues in the U.S., Europe, and Asia. Clients include regulatory institutions interested in market design and consumer impact issues, transmission companies and market operators studying system and market performance, and generation companies analyzing strategic company issues. In its first application, CEEESA staff members used the software to simulate the Illinois and Midwest power markets. This was done for the Illinois Commerce Commission which needed advice on whether the existing transmission system could support a competitive market. Other model implementations are conducted for clients in Europe and Asia.

|

|

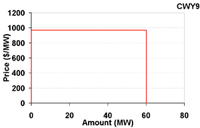

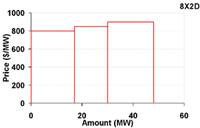

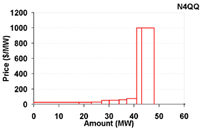

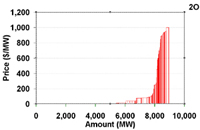

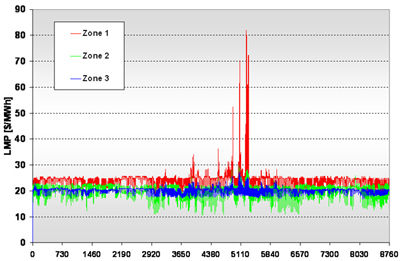

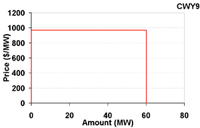

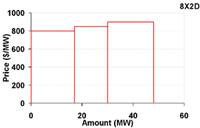

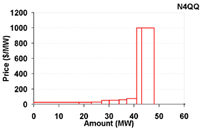

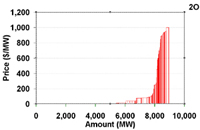

Evidence of Market Gaming: Below are several examples of bid curves taken from a recent data set (July 26, 2005) available on PJM's website. The bids are encoded to allow the anonymity of the bidders. We cannot identify the individual units or the companies. Also, some units may be aggregates of several units. Even though, this type of bidding behavior is "by the rules," it clearly shows that market participants engage in strategic behavior (such as economic withholding, hockey-stick bidding, etc.). There is also clear evidence of participants probing the markets by conducting repeated experiments and adapting their bidding style over time (learning and adaptation).

|

|

|

|

| Actual PJM Bid Curves for July 26, 2005: GenCo 9O bids 2 units (CWY9 and 8X2D) at

969 $/MWh and at 800-900 $/MWh into the market. GenCo D1 bids unit N4QQ at 27-75 $/MWh for the first 41 MW and at 1000 $/MWh for the last 7 MW. On a company-wide basis, GenCo 2O bids almost 9000 MW made up of 55 units into the market. Over 4000 MW were offered at 0 $/MWh, the last 1000 MW were offered at prices greater than 600 $/MWh. |

Training and Capacity Building: We have extensive expertise and experience in capacity building by assisting our EMCAS users around the world in the form of training and implementation support. Over the last 25+ years, we have conducted training courses in many locations around the world and have successfully trained over 1300 experts from more than 90 countries in the use of our tools. EMCAS is the latest in our software suite and is already in use in several countries.

EMCAS training courses and workshops can be tailored to your specific needs and can last anywhere between a few days to a couple of weeks. Courses may be held at Argonne's facility in the Chicago area or at your facilities.

Click here for information on past and upcoming training courses or click on the pictures below.

Additional Resources: For more information on the model, download the following brochures, presentations, and papers in PDF format:

EMCAS and other complex adaptive systems tools for analysis of energy markets and energy infrastructures are featured at the following websites:

- May 2005 Science Daily: Innovative Software Tools Keep Electrical Markets Humming

- Market Design using Agent-based Models (click here for pdf)

- Computerworld, August 14, 2000, Article "The Perfect Swarm"

- New York Times, July 2002: Article on President Bush's Visit to Argonne National Laboratory

- Iowa State University: Agent-based Computational Economics

- Santa Fe Institute: Robustness Laboratories

- IEEE Power Engineering Society: Guest Editorial on the Business of Power (click here for pdf)

- IEEE Power and Engineering Magazine, July/August 2004: Real World Market Representation with Agents (pdf)

- IAEE Denver 2005: Simulating GenCo Bidding Strategies (pdf)

- IAEE Washington July 2004: Modeling the Illinois Electricity Market (pdf)

- CSIRO: Australia's National Electricity Market modeled as a Complex Adaptive System

- Sandia National Laboratories: Survey of Grid Modeling Capabilities (pdf)

- Argonne Frontiers 2003: CASS Turns Simulation Upside Down

- Argonne Logo: Modeling World Turned Upside Down with New Simulation Software

- Modeling for Complexity - The Simulation of Economic Agents, February 2006 (pdf in Italian)

- VIP Geek July 2007: Portuguese Transmission Company REN Selects EMCAS for Analyzing Iberian Electricity Market

- Portuguese University Network December 2007: Introduction to EMCAS (in Portuguese)

- University of New Brunswick, Canada, 2007: Engineering Industrial Ecosystems in a Networked World (pdf)

- Harvard University/New England ISO, April 2002: A Catalog of Market Indeces (pdf)

- World Bank, March 2007: Risk Assessment Methods for Power Utility Planning (pdf) , report from a modeling workshop, invited speakers included Guenter Conzelmann and Tom Veselka

- ACM Transactions on Modeling and Computer Simulation, January 2006: Experiences Creating Three Implementations

of the Repast Agent Modeling Toolkit

- DOE Office of Science/University of Puerto Rico, 2007: Electricity Market Complex Adaptive System (EMCAS) as a Tool for Teaching Undergraduates about Power Market, Environmental Policies, and Renewable Energy

- Federal Laboratory Consortium for Technology Transfer, Midwest Region, Spring 2007: EMCAS Information

- Balkan Energy Solutions Team, November/December 2004: Introduction to EMCAS (pdf in English) (pdf in Serbo-Croatian)

- Proceedings of the 2005 Winter Simulation Conference, 2005: Tutorial on Agent-based Modeling and Simulation (pdf)

- Proceedings of the 2006 Winter Simulation Conference, 2006: Tutorial on Agent-based Modeling and Simulation Part 2 (pdf)

- Proceedings of the 2006 Winter Simulation Conference, 2007: Agent-Based Modeling and Simulation: Desktop ABMS (pdf)

- CSIRO, NEMSIM: Agent-based Simulator for Australia's National

Electricity Market

- Croatian Power Company (HEP), Using Multi-Agent Modeling and Simulation (pdf in Serbo-Croatian)

- Argentine Ministry of Energy, August 2006: Overview of EMCAS (pdf in Spanish)

Contact us if you are interested in a limited demonstration version of EMCAS or would like to receive a 30-day trial version.

|