| Center for Energy, Environmental, and Economic Systems Analysis (CEEESA) |  |

Research Areas:

Energy, Environment, and

Economics

National and Homeland

Security

Infrastructure Assurance

Emergency Preparedness

Social Dynamics

Policy Analysis

Core Capabilities:

Systems Analysis

Modeling, Simulation, and

Visualization

Complex Adaptive Systems

Decision Support and Risk

Management

Information Sciences

Argonne/University of Illinois Study Identifies Congestion Issues as a Potential Impediment to Competitive Electricity Markets in Illinois

The Illinois Commerce Commission (ICC) commissioned this study to be undertaken as a joint effort by the University of Illinois at Urbana-Champaign (UIUC) and Argonne National Laboratory to evaluate the Illinois situation in the 2007 period when restructuring is scheduled to be fully implemented in the State. The purpose of this study is to make an initial determination if the transmission system in Illinois and the surrounding region would be able to support a competitive electricity market, would allow for effective competition to keep prices in check, and would allow for new market participants to effectively compete for market share. The study seeks to identify conditions that could reasonably be expected to occur that would enable a company to exercise market power in one or more portions of the state and thereby create undue pressure on the prices charged to customers and/or inhibit new market participants from entering the market. The term “market power” has many different definitions and there is no universal agreement on how to measure it. For the purposes of this study, the term is defined as the ability to raise prices and increase profitability by unilateral action. With this definition, the central question of this analysis becomes: “Can a company, acting on its own, raise electricity prices and increase its profits?” It should be noted that the intent of the study is not to predict whether or not such market power would be exercised by any company. Rather, it is designed to determine if a set of reasonably expected conditions could allow any company to do so. It should also be emphasized that this study is not intended to be a comprehensive evaluation of the electric power system in the State. Rather, it is intended to identify some issues that may impact the effective functioning of a competitive market. Two analytical tools are used in this study: the PowerWorld® model and the Electricity Market Complex Adaptive System (EMCAS) model. PowerWorld Simulator is an interactive power system package designed to simulate high voltage power system operation. EMCAS uses an agent-based modeling structure to simulate the operation of the different entities participating in the electricity market. Assumptions: The analysis of the power system in Illinois in this study was based on a set of assumptions and input data. These assumptions and inputs were used to provide a straightforward set of conditions that could be used to determine how the power system might function. They were not intended to represent the predicted, most likely, or optimal set of conditions for the Illinois market. Rather, they were intended to test how the market might behave under a given configuration. The basic assumptions included the following: A single market for electricity will be operating in the State and surrounding study area in the analysis year of 2007. A single independent system operator (ISO) will operate the entire transmission system in the State. A day-ahead market (DAM) for energy and ancillary services will operate in the State. The DAM will allow suppliers (i.e., generation companies, or GenCos in the terminology of the analytical models used here) and purchasers (i.e., demand companies, or DemCos) to bid for their participation in the market. No bilateral contracts are assumed to be in place. There will be no tariffs or price caps to limit charges to consumers. The configuration of the power system in Illinois in the analysis year was constructed from the 2003 summer case prepared by the North American Electric Reliability Council (NERC), which includes about 1,900 buses and 2,650 branches in Illinois. In addition to the in-state transmission configuration, the power transfers into and out of the State were accounted for in order to get an accurate picture of how the State’s system would perform. PowerWorld used a larger portion of the eastern interconnection. EMCAS used a reduced out-of-state network with transmission capacity that allowed power to move into and out of the State. Load forecasts were based on data contained in Federal Energy Regulatory Commission (FERC) Form 714. Generation capacity additions were taken from FERC, Energy Information Agency (EIA), and Illinois EPA sources. About 6 GW of new capacity represented a growth of about 14% from 2001 levels. Fuel price projections were based on regional forecasts produced by the EIA National Energy Modeling System (NEMS) model that are reported in its Annual Energy Outlook (AEO). Case Studies: The basic assumptions were grouped into two sets. The Case Study Assumptions provided a point of comparison for a single configuration and operating profile of the power system. The Conservative Assumptions were designed to verify that the results and conclusions were not distorted by the details of this single configuration. Under Conservative Assumptions forced outages and company-level unit commitment decisions were eliminated. Also, generation production cost included only fuel and variable operation and maintenance costs under Conservative Assumptions. Using the basic assumptions and inputs, alternative cases were analyzed to determine how the Illinois market might function in the analysis year. The cases studied included the following:

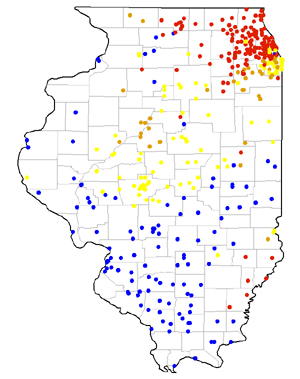

Basic System Status (a) The State has an adequate supply of generation capability to meet its needs and to export power to surrounding areas. It might even be argued that there is an excess of capacity given that the projected statewide generation reserve margin (in excess of 40%) is higher than what is generally used for system reliability planning. Further, some generators would not be dispatched at all under the conditions laid out in the PC case. (b) The ownership of the generation capacity is concentrated in five companies: Exelon Nuclear, Midwest Generation, Ameren, Dynegy, and Dominion Energy. Together, they account for more than 77% of the generation capacity in the State. If they were to be dispatched under PC case market conditions, they would account for about 98% of the electricity generated in the State. Using any one of a number of measures of market competition, the State’s generation capacity can be considered to be concentrated. With this degree of concentration and with much of this capacity in the form of low cost nuclear and coal units, it would be difficult for new generation companies to enter the deregulated market. In fact, many of the existing natural gas units, some of which are only a few years old, would have difficulty competing in this market. (c) During the high load periods, which occurred about 5% of the time, electricity prices rose, since higher-cost generators had to be brought on-line to meet loads while maintaining the integrity and stability of the power grid. Even without any attempt to manipulate prices on the part of generation companies, prices were as much as 30% higher in high load periods. (d) The transmission system in the State has areas that show evidence of congestion. Some transmission equipment was operated at its capacity limits for a significant number of hours in a year. The congested regions include the City of Chicago, the areas north and west of Chicago out to the Iowa border, a broad area stretching southwest of Chicago to Peoria and Springfield, and several smaller isolated areas in the southern part of the State. The effects of the transmission congestion were more prevalent during peak load periods, during which prices spread across the State. Price variations across the State due to transmission congestion were as much as 24% during these peak load periods. (e) Using Conservative Assumptions, in which more generation capacity was assumed to be made available by the elimination of forced outages and company level unit commitment decisions, the results did not materially change. The generation market was still concentrated and transmission congestion was still evident. Price variations, though smaller in absolute magnitude, were equivalent in relative terms. (f) Under a fully competitive market in the State using the market rules assumed here, some generation companies were pressed to maintain operating profitability. Only 6 out of 24 generation companies in the State were able to operate profitably. The dominance of the low cost nuclear and coal units made it difficult for others to compete. Under Conservative Assumptions, none of the generation companies, except Exelon Nuclear, was profitable. Exelon’s operating profit was very small. For both the Case Study Assumptions and the Conservative Assumptions, the analysis period was only one year, and an assessment of long-term profitability that includes factors such as capital outlays was not included. Market Power Potential (g) If generation companies seek to raise market prices by physically withholding single units from service, the results here show that, for the most part, they would not likely benefit. Because of the abundance of generation in the State, there was almost always another unit that could be brought into service to replace one that was withheld. This is true even in light of the transmission congestion. (h) In contrast, physically withholding multiple units that are strategically located in the transmission network, particularly during peak load conditions, can increase profitability. A single company using a strategy based on indicators of system reserve margin to identify times to withhold capacity and indicators of locational prices to identify which capacity to withhold could significantly increase its profitability. This type of strategic physical withholding could even create conditions where some load cannot be met and could result in very steep price increases. Exelon Nuclear, Midwest Generation, and Ameren all had market power (as defined here) when using this strategy. Dynegy and Dominion Energy did not. (i) If the major generation companies sought to raise market prices by unilaterally increasing the price of their units (i.e., by economic withholding), the results would be mixed. Applying a price increase to all units for all hours increased profits for Exelon Nuclear and Midwest Generation, but at the expense of significant loss in generator dispatch since some of the higher cost units would be selected only sporadically by the market. The resulting dispatch schedule may not be technically practical for the companies’ larger units. For Ameren, Dynegy, and Dominion Energy, the higher priced units would not be selected in the market and the price increase gained by other units would not be sufficient to recover the lost revenue. Profitability decreased. (j) Alternatively, a more limited application of price increases that was restricted to peak hours only allowed Exelon Nuclear and Midwest Generation to significantly increase profits with only a small decrease in generator dispatch. Ameren, Dynegy, and Dominion did not see any profit increase by applying this strategy. The same was true under Conservative Assumptions except that Exelon would need very large price increases to increase its profitability. When using this strategy, Exelon Nuclear and Midwest Generation had market power according to the definition used here. (k) By raising their prices, all generation companies could cause consumer costs to rise, some by as much as 250% in some parts of the State on a peak day. However, only Exelon Nuclear and Midwest Generation saw a significant increase in their operating profits by applying this strategy. Overall, the answer to the basic question of the study, “Can a company, acting on its own, raise electricity prices and increase its profits?” is affirmative. There is a concentration in the generation market and evidence of transmission congestion, at least during high load periods. This will give rise to the ability of some companies to unilaterally raise prices and increase their profits. Consumer costs will increase, in some cases substantially. However, the situations under which this can be done are limited to a number of conditions, especially high load periods. Comments and Observations from Market Participants: Work on the study started in July 2002. The initial draft report was submitted in December 2003. Following a review by ICC staff, a revised draft report with additional analyses was submitted in September 2004. This version of the report was presented to the Transmission Advisory Group (TAG) in May 2005. TAG members were given an opportunity to review the report in detail and submitted their final comments in January 2006. Most of the issues identified in these independent reviews focused on the following main points: (1) Use of outdated data, (2) current market rules are not included, and (3) no consideration of impacts of current Midwest ISO and PJM market monitoring. The report authors provided their response to these comments in March 2006 (Argonne and UIUC) and submitted the final report and its appendices with minor editorial changes to the ICC in April 2006. The ICC Commissioners and the public were briefed by Argonne and UIUC on the findings of this analysis at a public hearing held on June 5, 2006 in Chicago. EMCAS Training and Implementation Support: Argonne recently made EMCAS available for commercial use. The model is now available under licensing arrangements with our software distributor, ADICA Consulting, LLC. Please contact us for more information. We regularly conduct training courses. Over the last 3 years, Argonne has hosted several international EMCAS training courses and hands-on workshops. The courses were attended by about 70 participants from 22 countries. Click here for information on past and upcoming training courses. Additional Resources: For more information on this application and the EMCAS model, download the following brochures, presentations, and papers in pdf format:

For more information, contact contact CEEESA |

| U.S. Department of Energy Office of Science | UChicago Argonne LLC |

| Privacy & Security Notice | Contact Us | Search |