| Center for Energy, Environmental, and Economic Systems Analysis (CEEESA) |  |

Research Areas:

Energy, Environment, and

Economics

National and Homeland

Security

Infrastructure Assurance

Emergency Preparedness

Social Dynamics

Policy Analysis

Core Capabilities:

Systems Analysis

Modeling, Simulation, and

Visualization

Complex Adaptive Systems

Decision Support and Risk

Management

Information Sciences

The Value of Product Flexibility in Nuclear Hydrogen Technologies Nuclear Hydrogen Technologies: This paper expands on our previous work by moving beyond levelized cost calculations to look at profitability, risk, and uncertainty from an investor’s perspective. We analyze a number of nuclear hydrogen technologies and quantify the value of certain technology and operating characteristics. In the initial analysis reported here, we evaluate the technologies described in Table 1. TABLE 1: Nuclear Hydrogen Production Technologies.

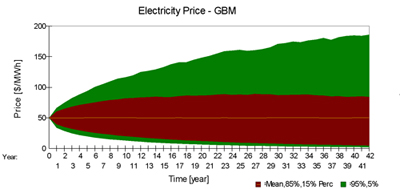

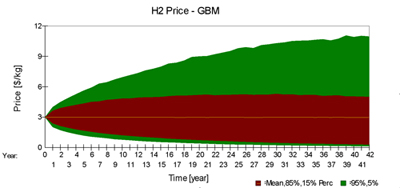

Stochastic Profitability Assessment: We develop a model to assess the profitability of these technologies based on Real Options Theory [1, 2]. The model is used to calculate the discounted profits from investing in each of the production technologies. The model uses Monte-Carlo simulations to represent the uncertainty in hydrogen and electricity prices. Hence, the model can compute both the expected value and the distribution of discounted profits from the production plant. Uncertainty in electricity and hydrogen prices can be represented with two different stochastic processes: Geometric Brownian Motion (GBM) and Mean Reversion (MR). Figure 1 shows the electricity and hydrogen prices generated by GBM. Figure 1: Simulated Distributions for H2 and EL Prices

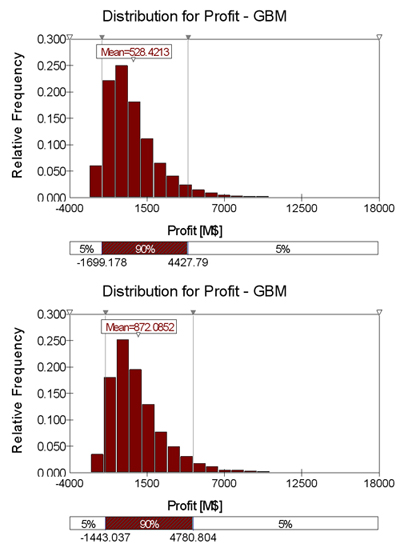

We quantify the value of the option to switch between hydrogen and electricity production by comparing the model’s computed expected profit with a flexible and inflexible plant assumption. A flexible plant is assumed to be able to switch between hydrogen and electricity instantaneously, depending on the respective market prices and what is more profitable to sell. Our analysis finds that the flexibility to switch between hydrogen and electricity production leads to a different profitability ranking of technologies, compared to a levelized cost analysis for hydrogen as the sole product. The flexibility in output products clearly adds substantial value to the HPE-ALWR and HTE-HTGR plants, as shown in Table 2 and Figure 2. In fact, under the GBM assumption for prices, the HTE-HTGR plant becomes more profitable than the SI-HTGR configuration, even though SI-HTGR has a much lower levelized cost for hydrogen production. For the HTE-HTGR plant it is also profitable to invest in additional electric turbine capacity (Case b) in order to fully utilize the heat from the nuclear reactor for electricity production when this is more profitable than producing hydrogen. TABLE 2: Expected Profit (GBM Assumption).

Figure 2: Distribution of Profits (M$) for Inflexible and Flexible Operation

Discussion and Future Work: The nuclear hydrogen technologies analyzed here are all at the research and development stage, so there are significant uncertainties regarding the technology cost and performance assumptions used in this analysis. As the technologies advance, the designers need to refine the cost and performance evaluation to provide a more reliable set of input for a more rigorous analysis. Given the potential significant economic benefit that can be gained from product flexibility and the ability to quickly react to market signals, we recommend that future R&D efforts look at developing durable materials and processes that can enable this type of operation. Our future work will focus on analyzing a wider range of hydrogen production technologies and an extension of the financial analysis framework presented here. We are planning to address a variety of additional risks and options, and to analyze optimal investment timing, the value of modular expansion, and optimal sizing of hydrogen storage facilities.Additional Resources:

For information on using agent-based modeling and simulation for hydrogen transition analysis, click here. For more information, contact contact CEEESA |

| U.S. Department of Energy Office of Science | UChicago Argonne LLC |

| Privacy & Security Notice | Contact Us | Search |

Introduction:

Introduction: