| Center for Energy, Environmental, and Economic Systems Analysis (CEEESA) |  |

Research Areas:

Energy, Environment, and

Economics

National and Homeland

Security

Infrastructure Assurance

Emergency Preparedness

Social Dynamics

Policy Analysis

Core Capabilities:

Systems Analysis

Modeling, Simulation, and

Visualization

Complex Adaptive Systems

Decision Support and Risk

Management

Information Sciences

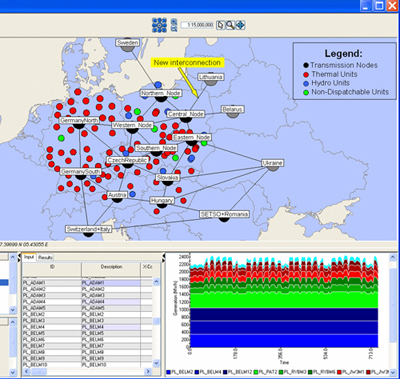

Competitiveness of Nuclear Power in Poland Given Poland's interest in nuclear power, the U.S. Department of Energy has asked Argonne National Laboratory to assess the competitiveness of the nuclear power generation technology vis-à-vis other competing technologies. The analysis was conducted in stages at different levels of detail. First, a screening analysis was performed to identify a representative candidate nuclear technology for Poland. Then, we performed a least-cost system expansion analysis using the WASP-IV model for the Polish power system until 2030 to determine the capacity needs and timing of nuclear capacity additions. Finally, we used a simplified zonal representation of the Polish power grid to determine the best regional location for the new nuclear power plant using our EMCAS model. In addition, a potential location of a shared nuclear generating unit in Lithuania was also examined. The figure below shows the system configuration in EMCAS. The configuration included Poland and all interconnected neighboring systems. Click on the picture to see a larger version.

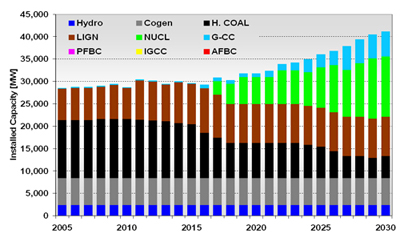

Prior CEEESA Experience in Poland: Upon invitation by the International Atomic Energy Agency (IAEA), Argonne-CEEESA assisted the Polish Energy Market Agency (EMA) in September 2005 in preparing power market forecasts for the Polish Power Grid Company. The most recent Poland report, based on energy supply and demand projections in 2001, identified nuclear energy as a potential supply source, particularly if natural gas prices spiked and/or natural gas supply from the East becomes vulnerable to supply interruptions. In addition, the report pointed out that Poland needed to improve its environmental record in reducing emissions, particularly NOX and SOX, if coal-fired generation reliance continued. The 2005 assistance was designed to prepare updated long-term power market forecasts for the Polish Power Grid Company. As part of the 2-week workshop, an Argonne expert reviewed the input assumptions for the EMA case studies, conducted joint model runs with the EMA team, and reviewed preliminary projection results. The study evaluated the competitiveness and future role of different power generation technologies (coal, gas, and nuclear) in the Polish generating system. Over the last 10 years, Argonne-CEEESA has repeatedly worked with Poland’s EMA in the areas of energy and power market analysis. Funded by the IAEA’s Technical Cooperation (TC) department, CEEESA worked with EMA for 2 years (1996-1997) on implementing the ANL-developed Energy and Power Evaluation (ENPEP-BALANCE) model. Under a follow-on IAEA-TC project during 1999-2001, CEEESA assisted EMA in implementing the WASP long-term power system expansion model, as well as the ANL-developed Generation-Transmission Maximization (GTMax) model. Click here for a brief description of the Polish GTMax analysis. The full report that documents both TC studies was published in 2002 and is available by clicking here. IAEA TC activities are designed to build local analysis capabilities. The Poland project was highly successful as EMA is now relying on ENPEP-BALANCE to prepare regular 20-year energy projections for the Polish Ministry of Energy. Similarly, EMA continues to use WASP to prepare power sector projections for the Ministry of Energy and the Polish Power Grid Company. Over the years, EMA experts have visited Argonne-CEEESA many times as part of energy and power market analysis workshops funded by a number of sponsors. For example, a team of Polish experts participated in a 2-week Argonne-IAEA training course in June 2006 on “Competitiveness of Nuclear Power and Other Energy Technologies in Restructured Electricity Markets.” During the course, participants learned how to use Argonne’s brand-new deregulated power market analysis tool, the Electricity Market Complex Adaptive System (EMCAS).Findings: Given a constrained carbon environment, the risks of future natural gas supplies, and the need to move to market-based electricity prices, the study found the following: (1) the deployment of new nuclear energy in Poland itself is very competitive in the next decade or two; (2) based on the results of the economic models, the initial plants will be competitive as early as the 2017 time frame as shown in the figure below, about four years earlier than the official Government timetable for new deployments within Poland; (3) nuclear energy’s share of the Polish electricity market could grow to as much as 40%; (4) as a first priority, the early plants should be sited in the northern sector of Poland, in the vicinity of Gdańsk, to address electricity shortfalls in that region; and (5) Poland would also benefit from diversity of electricity supply strategies, including the flexibility of importing electricity from Lithuania. The four main economic drivers benefiting nuclear energy in Poland are:

Poland appears to have significant potential to be a partner in GNEP as an emerging nuclear energy country. It appears that nuclear fuel leasing would be the best fuel supply and disposition alternative. Within the EU, all investment activities in the energy sector must be reviewed as part of a formal public acceptance process. Poland’s National Atomic Energy Agency has already conducted polling and has found increasing public acceptance. Polish authorities have stated that this public polling process will be completed within five years. Application of this Study to Other Countries: The likelihood that other Central and Eastern European (CEE) countries will be GNEP partners is equally high because of concerns about their natural gas supply situations and their need to move to a carbon-constrained economy. Such an arrangement, in the short term, could be implemented most expeditiously as a multinational nuclear energy project among the CEE countries, similar to the trans-Baltic project that is now under active consideration. The potential to deploy future nuclear plants and become a GNEP partner may also be significant for non-CEE countries, specifically, developing countries in Asia, Africa, and South America. As these countries improve their standards of living, their needs to diversify their supplies of energy will increase, and, due to likely financial constraints, the interest to develop a regional approach to nuclear deployment will grow as well. Additional Resources: For more information on this analysis and the software tools used, download the following brochures, presentations, and papers in pdf format:

For more information, contact CEEESA |

| U.S. Department of Energy Office of Science | UChicago Argonne LLC |

| Privacy & Security Notice | Contact Us | Search |