| Center for Energy, Environmental, and Economic Systems Analysis (CEEESA) |  |

Research Areas:

Energy, Environment, and

Economics

National and Homeland

Security

Infrastructure Assurance

Emergency Preparedness

Social Dynamics

Policy Analysis

Core Capabilities:

Systems Analysis

Modeling, Simulation, and

Visualization

Complex Adaptive Systems

Decision Support and Risk

Management

Information Sciences

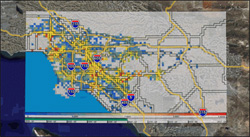

Multi-Agent Simulation of Hydrogen Transition IssuesIn collaboration with RCF Consulting, Ford Motor Company, BP, and others, Argonne is applying agent-based modeling and simulation techniques to analyze the early transition phase to a potential hydrogen-based transportation system. This spatially explicit software has several thousand agents and is currently implemented for the greater Los Angeles area with several extensions under way.

The investor agents in the model decide the type of supply infrastructure and how much and where to locate it. These investment decisions are made with imperfect knowledge of driver vehicle purchase and fueling behavior, the expected penetration of hydrogen, the plans of competitors, and the total demand for fuel. Thus, investors need to develop expectations that can be used as a basis for their decisions. We model investors as agents that are trying to do the best they can, given the uncertainties they face. Our investors may make nonoptimal decisions and may learn from their experience. The model distinguishes between different types of investor agents—from risk prone to risk averse—with different relative risk aversion coefficients. For more information, contact: |

| U.S. Department of Energy Office of Science | UChicago Argonne LLC |

| Privacy & Security Notice | Contact Us | Search |

Argonne’s model uses the road topology of a real metropolitan area, the Los Angeles basin. The driver agents vary in income, live and work in the LA area, and have attributes such as “greenness.” Further, they are influenced in their purchase decisions not only by their personal experience and a general “belief space” that reflects the attitude of society in general toward hydrogen, but also by their interactions with peers. Their decision to purchase is implemented in the form of a utility function that computes the sum of all adoption incentives less the disincentives of inconvenience and worry about running out of fuel. It also considers their willingness to pay more or suffer more inconvenience to operate a vehicle that has desirable environmental characteristics.

Argonne’s model uses the road topology of a real metropolitan area, the Los Angeles basin. The driver agents vary in income, live and work in the LA area, and have attributes such as “greenness.” Further, they are influenced in their purchase decisions not only by their personal experience and a general “belief space” that reflects the attitude of society in general toward hydrogen, but also by their interactions with peers. Their decision to purchase is implemented in the form of a utility function that computes the sum of all adoption incentives less the disincentives of inconvenience and worry about running out of fuel. It also considers their willingness to pay more or suffer more inconvenience to operate a vehicle that has desirable environmental characteristics.